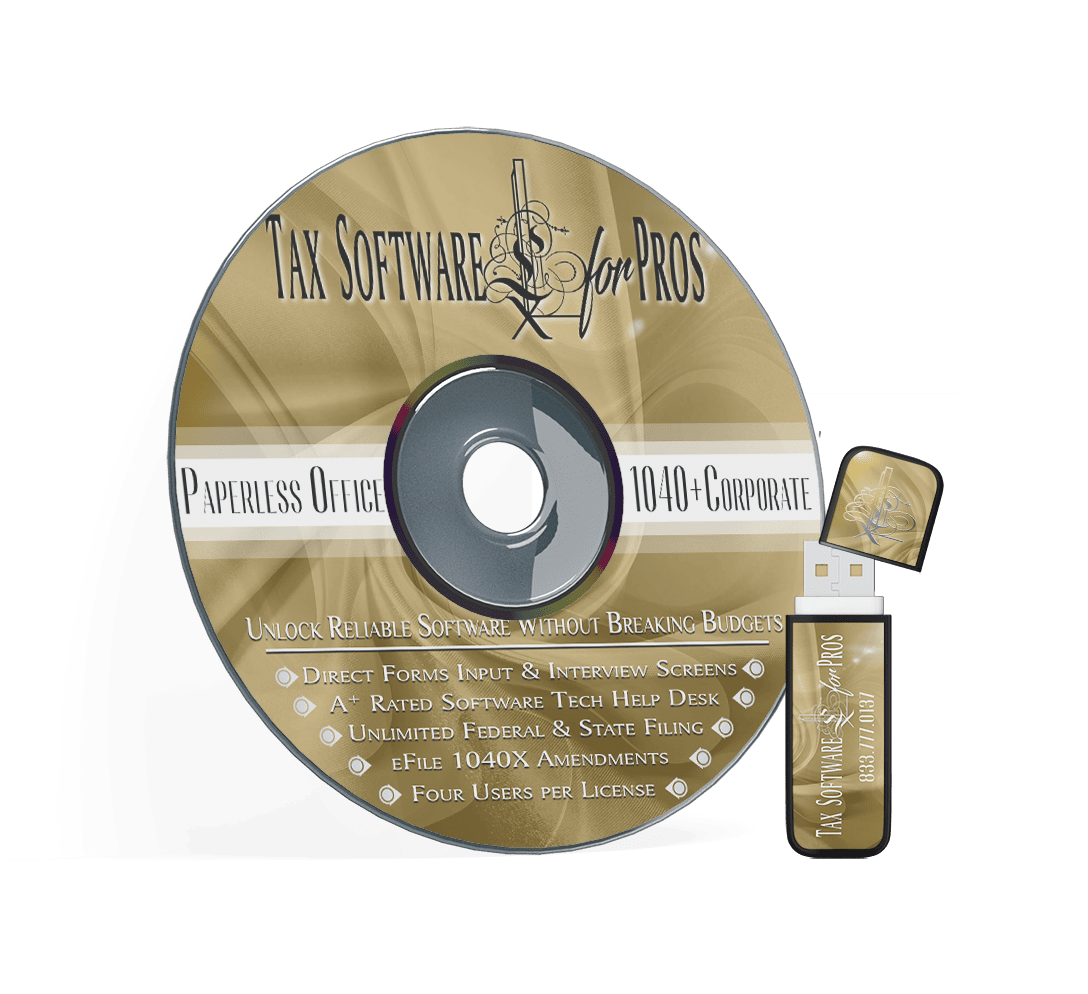

Unlimited 1040 Software

FPO 1040 Cloud Tax Software

Say goodbye to hefty license fees. Get Automatic Access to 1040 + 1040X forms to save time and provide Tax Office efficiency. The MTO Mobile App comes ready to use with a cohesive online portal integrated for those that do now want to download the a

$492How to order?

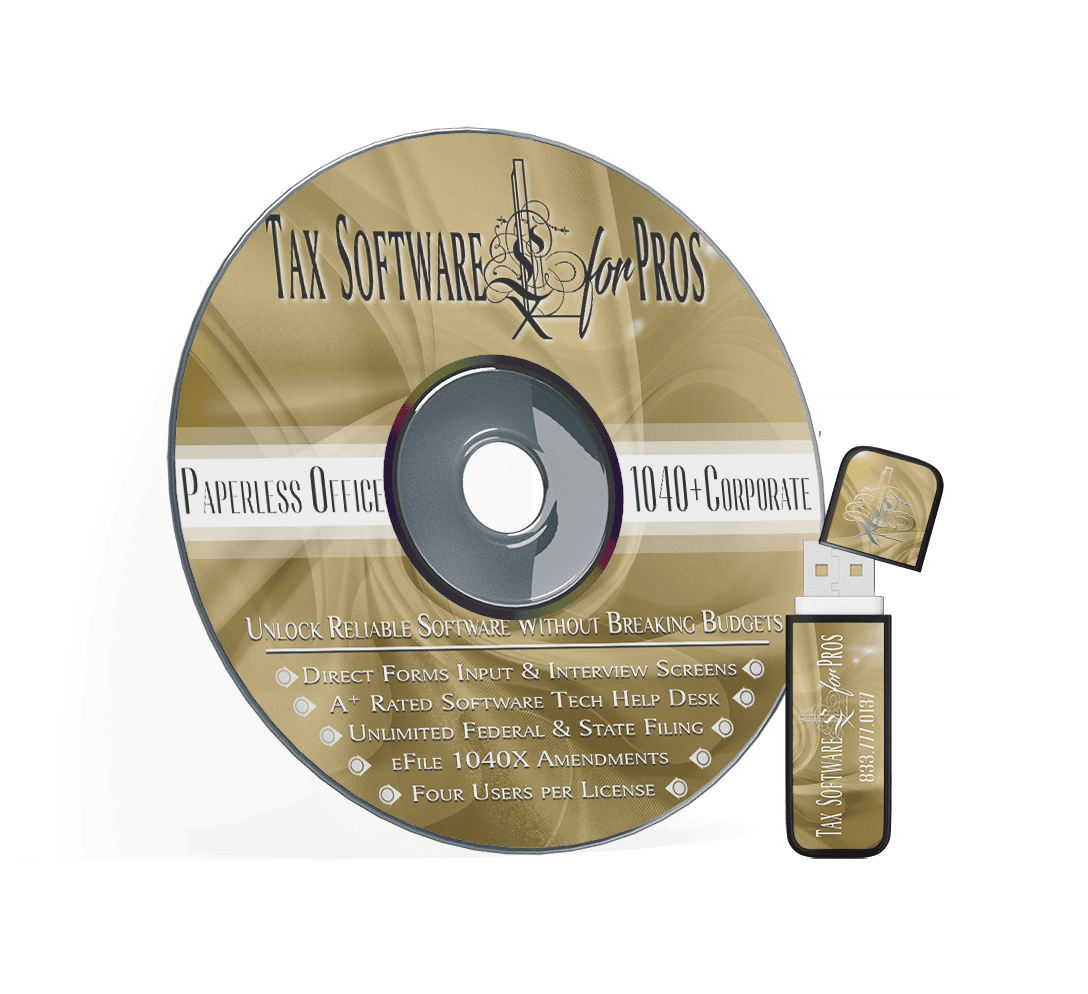

Corporate Software Add-On

Never loose another client by having 1120 and 1065 software at your fingertips. Confidently prepare forms for Corporations, Partnerships, Trusts, and Non-Profits with the add-on.

$347

TERMS OF USE

Must Hold an EFIN Number upon purchase of the software as it will need to be entered into the software before delivery.

Must be a resident of the United States.

DURATION:

Term license is good for one tax season using Tax Year 2025 Software with access to 2024 and 2023. Prior year software 2022-2018 are $20 each.

USERS:

Your license will allow up to four users to login and use the software. A user is considered to be someone with a PTIN that will prepare. Users providing data entry as staff do not have any usage requirements.

3rd PARTY BANKS:

If you provide Refund Advances, Direct Refund Transfer, Debit Cards, or Checks, you will need to apply for Bank Products through the integrated 3rd parties. Once approved with the banks (Refund Advantage, Santa Barbara, or Republic, fees will occur for your clients upon submittal.

3rd PARTY FEES:

Technology and Transmission Fee: $40

Service Bureau Fee $30

3RD PARTY ANCILLARY SERVICES:

Protection Plus Audit Protection $25

Identity IQ $30